Fuel transactions are as easy as swiping a card at the pump, but other types of over-the-road purchases are not so simple for drivers. An unexpected breakdown, for example, may require the driver to call to the office and request a money code.

In many respects, the methods that fleets use to get cash to drivers have not changed since the 1970s when Comdata developed its Comchek network to replace the need to use Western Union.

A trucking company can issue Comchek Express Codes for specified amounts that drivers can redeem for cash at merchants in Comdata’s network. Over 700,000 payments go through Comchek every year, but increasingly fleets and drivers are turning to digital solutions to add more security and convenience.

Last year, Comdata launched OnRoad, a Mastercard-branded fleet card that combines driver funding with fuel payments. The funding tools of OnRoad let fleet deposit cash advances, payroll and settlements directly to the card accounts of drivers who use OnRoad as a personal debit card.

When drivers use OnRoad to make a non-fuel purchase, the card automatically debits the driver’s personal fund balance.

Comdata has a cloud-based software product, Comchek Mobile, that drivers can also use to receive funds. Drivers can enter a Comchek Express Code to transfer funds into the mobile digital wallet app. The funds are immediately available and can be transferred to the driver’s OnRoad Mastercard or to an external linked bank account.

About 10% of Comchek transactions go through the Comchek Mobile Platform at present, says Justin King, Comdata’s senior vice president of product. By having funds available on the mobile app, a driver gains another convenience of peer-to-peer payments. The mobile app has functions similar to digital wallet apps used by consumers like Venmo.

A driver could transfer funds received from Comchek Mobile to other users in the network, such as lumpers, by entering the unique ID of the payee.

Making it easy for vendors

Just as digital payment systems are becoming the norm for fleets and drivers, vendors have new technology options that can replace traditional point-of-sale systems.

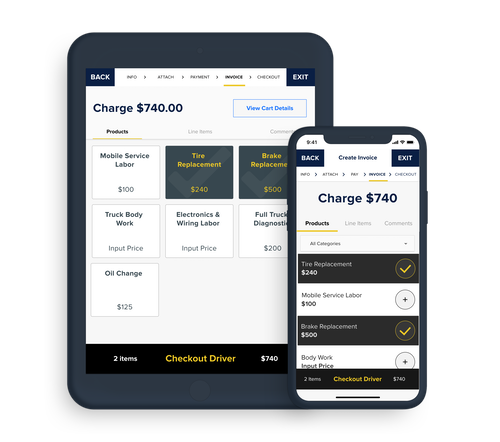

RoadSync launched a mobile payment system for the transportation industry in 2017. The cloud-based point-of-sale platform has invoice generation and workflow tools designed for people and businesses to request and accept payments digitally.

Robin Gregg, chief executive officer, describes it as a version of Square that was built specifically for handling payments in the transportation and logistics industry.

RoadSync has established itself in the transportation industry as a mobile payment platform used by road service providers.

“We figured out how to create an experience that works for logistics and transportation by using industry-specific forms and workflows,” she says.

People and businesses can use RoadSync to collect payments from owner operators and company drivers for common over-the-road services and expenses. For example, warehouses use RoadSync to collect accessorial fees for loading and unloading trailers. It also counts truck repairing and towing companies among its customers.

“Companies that do repairs and tow merchants are able to send out digital work authorizations to the company with clarity about what is going to be charged,” she says.

The driver can pay for a transaction using any debit or credit card on the spot. The platform also allows the merchant to text or email the invoice to a motor carrier for real-time payment.

Funds received through the app for payment are deposited directly into the bank account that the user chooses. RoadSync plans to release a new feature for smaller customers that will enable them to have funds transferred directly to a debit card, she says.

A new feature, Express Deposit, allows RoadSync users to cash out minutes after a transaction is completed. Standard payments typically take between two and four business days, but customers using Express Deposit can receive funds on their debit card in 30 minutes or less for a transaction fee.